When Isabelle Maraschi visited Sacred Heart University in Fairfield, Connecticut, in March 2018, she could finally see herself as the doctor she had always dreamed of becoming. “I sat in on a premed class and everyone had been accepted to the greatest medical schools—Brown, Stanford, Columbia,” she recalls. The campus itself felt perfect, like some sort of academic utopia: “I completely fell in love with it—the buildings, the people,” she says. “It was springtime and everything was so beautiful.”

Sacred Heart had already accepted Isabelle, now 19, in a letter she’d received that same month (“I cried when I read it”). She’d applied to nine schools, including two state universities, but as the daughter of Brazilian immigrants—her mom is a house cleaner and her father, now estranged, is a mechanic—she viewed a degree from a private college as the ticket to success and status. So while most of her high school classmates in Malden, Massachusetts, signed on to attend the University of Massachusetts-Amherst, Isabelle excitedly taped the letters SHU to her graduation cap.

Shortly thereafter, things started to fall apart.

In late June, Isabelle received a bill from SHU telling her she owed $7,900 for her first semester. She couldn’t come close to paying that amount with the money she earned as a lifeguard and occasional babysitter. Her mom couldn’t pay it either, on top of her rent. More important, Isabelle had been under the impression that most of her costs would be covered by SHU.

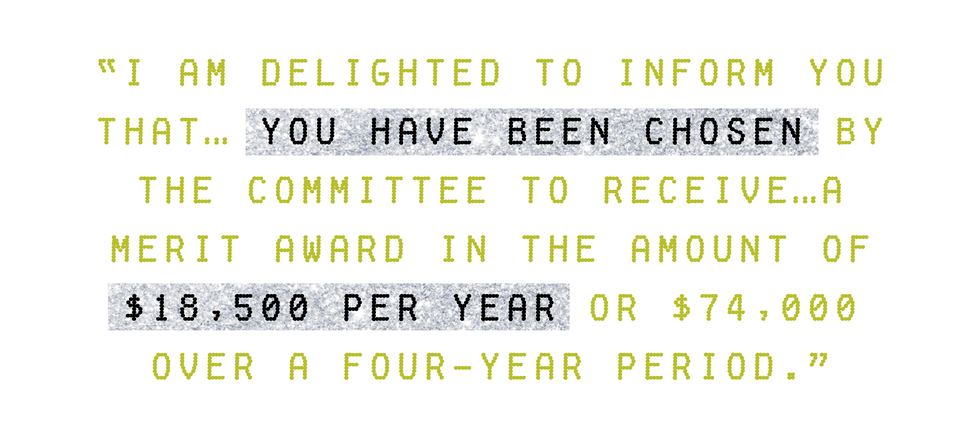

The reason she believed that: The second sentence of her acceptance letter, following SHU’s warm welcome, had read: “I am delighted to inform you that…you have been chosen by the committee to receive…a merit award in the amount of $18,500 per year or $74,000 over a four-year period.” It echoed a letter she’d received in February, before even finishing her application, which had urged her to complete the admissions process since she was “eligible” for this “merit award.” The letters, signed by Julie B. Savino, executive director of University Financial Assistance, made no mention of a more important number: the actual cost of attending SHU, which is nearly $60,000 per year.

And so Isabelle, who had a 3.9 high school GPA, assumed her merit award (which included a President’s Excellence Award) plus loans would cover the majority of her expenses. “It was an insane amount of money,” she says. “I couldn’t even imagine having that much money. I felt so special. Like, Wow, they’re really investing in me. I should go there.”

So enchanted—and blinded—was she by her “award” that she admits to not paying much attention to another letter that arrived a few weeks after her acceptance: her actual financial aid award notification. Unlike the two previous letters, this one did list the school’s cost of attendance, including tuition, room and board, books, and personal expenses. It said that after her “merit aid,” she’d have roughly $30,000 to cover, then listed a variety of federal grants and loans she was eligible for.

With the help of an outside counselor working for uAspire, a nonprofit dedicated to college affordability, Isabelle examined the letter. And again, it looked like a whole lot of money was being offered to her. Especially since she had also managed to get more than $10,000 in outside scholarships: $6,000 from uAspire that would renew at $6,500 for her sophomore year and another one-time scholarship of $4,300 from her high school.

With all this aid coming in, she says, “I didn’t do the exact calculations. But I figured with all the money I was getting from so many sources, I couldn’t have owed much more, or maybe even any more.” Isabelle’s counselor told her Sacred Heart would be more expensive than a state school, but her mind was made up.

“In my heart, I knew it would all work out,” she adds. She was a first-generation college student. She was also 18: “Even for kids like me who struggled financially, we were thinking about whether or not we would be accepted, not how we would pay.”

In late April, just before the May 1 deadline, Isabelle put down her $1,500 nonrefundable deposit with no hesitation: “I felt like all my hard work had finally paid off.” But in June, the bill from SHU caused her illusions to come crashing down. Like too many aspiring college students, Isabelle had been enticed by a promise of financial aid that downplayed the costs she’d still be on the hook for.

Suddenly, her dreams of being a doctor felt totally up in the air. “I was devastated,” she says.

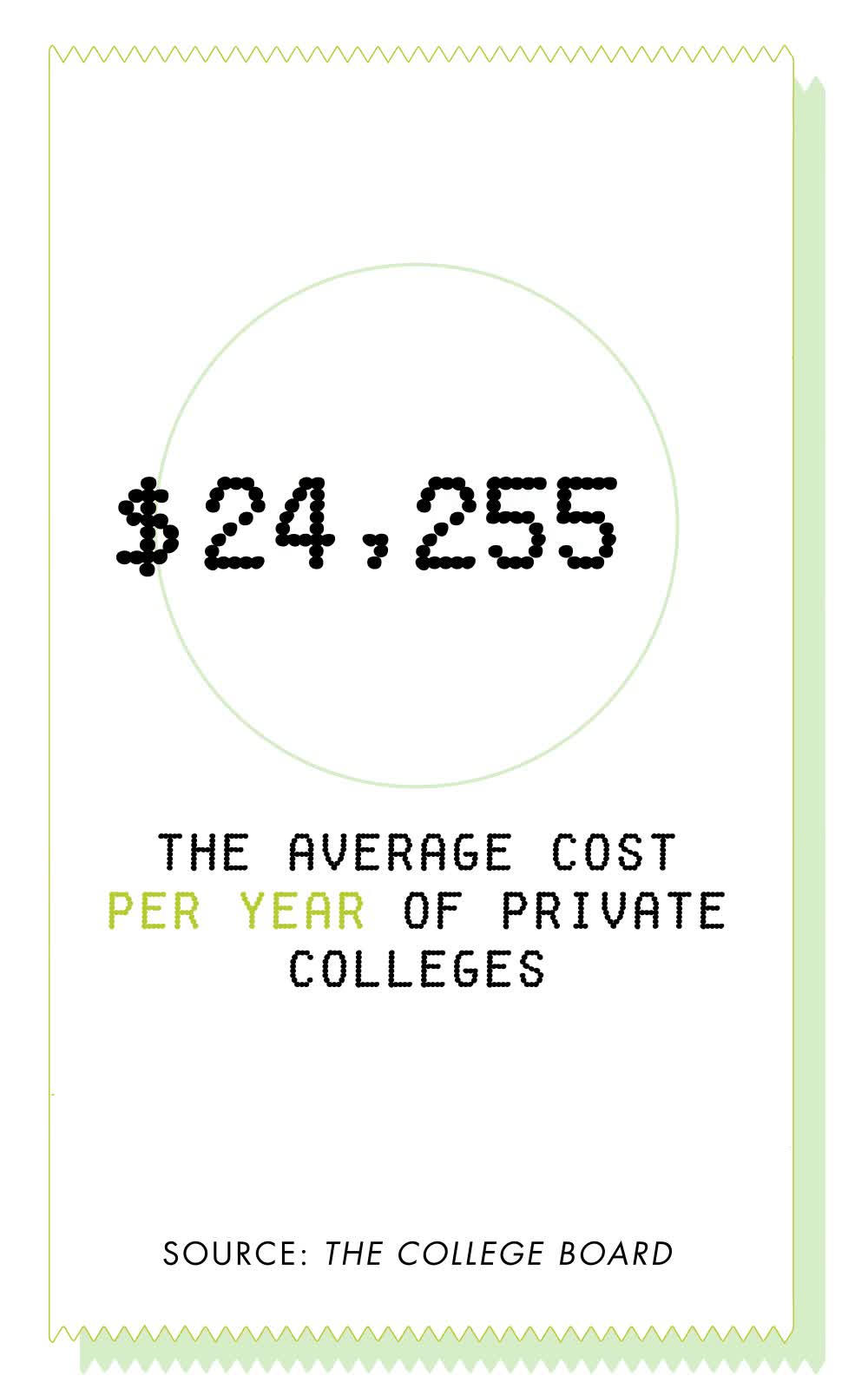

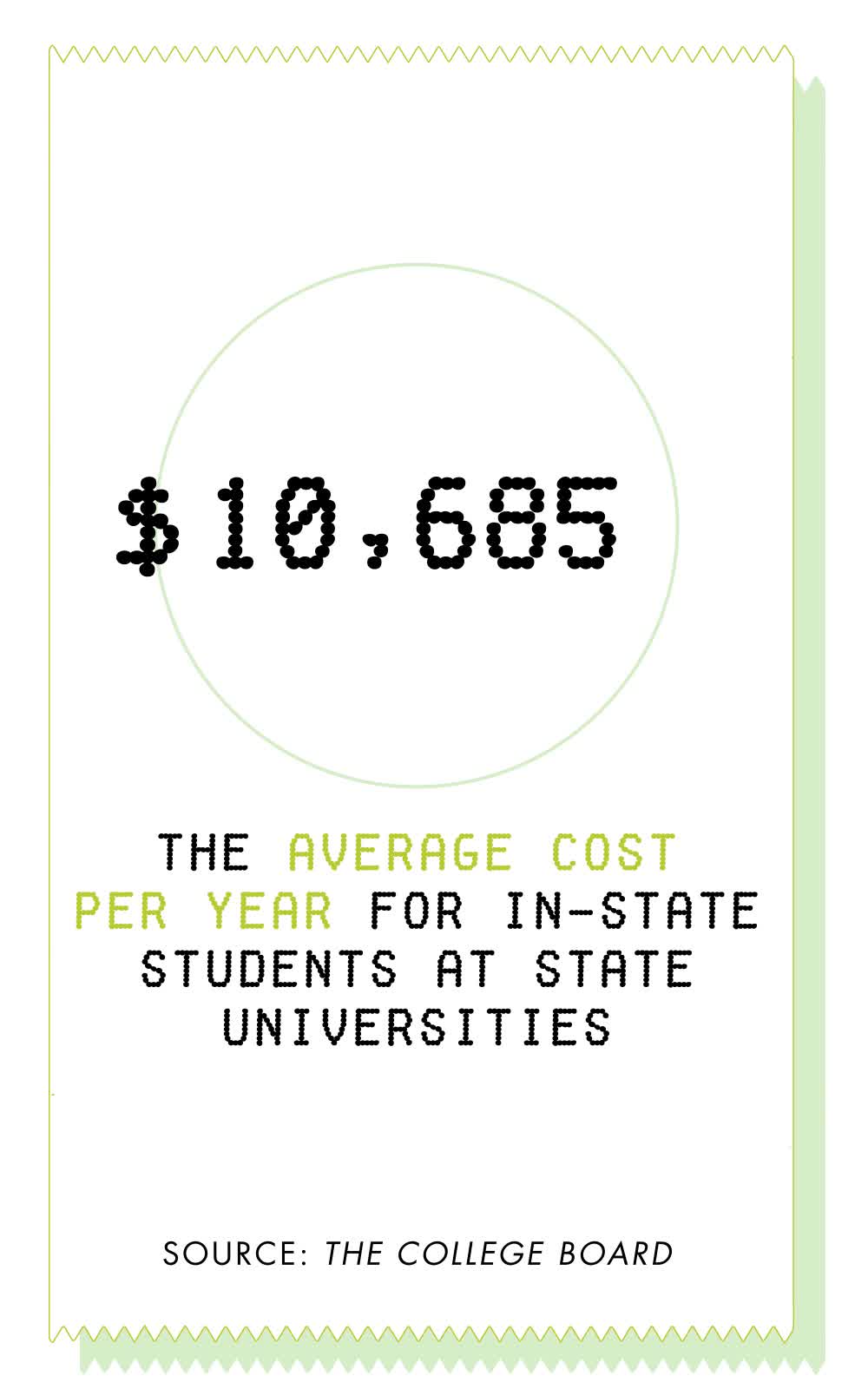

Each spring, hundreds of thousands of high school seniors lay down nonrefundable deposits on the colleges they have chosen to attend. Many students base their decisions on information contained in award letters that precede, accompany, or arrive soon after their acceptance letters. These letters detail the types of help a student is being offered for their first year: loans, scholarships, grants, and work-study programs that, taken together, will help ease the astronomical expense of a degree, which in 2018 averaged $48,510 per year at private institutions and $21,370 for in-state students at public universities, according to The College Board.

But while the purpose of financial aid letters is to say how much a student will have to pay, the reality is that most of them don’t. Instead, their inconsistent terminology, shifting formats, and omissions of critical information—like the full cost of a school—at best confuse and at worst mislead incoming freshman as they are about to make the most important financial decision of their young lives.

“It’s like buying a car but not knowing how much the car costs,” says Laura Keane, chief policy officer at uAspire. (Except that four years of college is actually like buying six or seven new cars.) “Nearly two-thirds of the time, students are making this decision without all the information they need.”

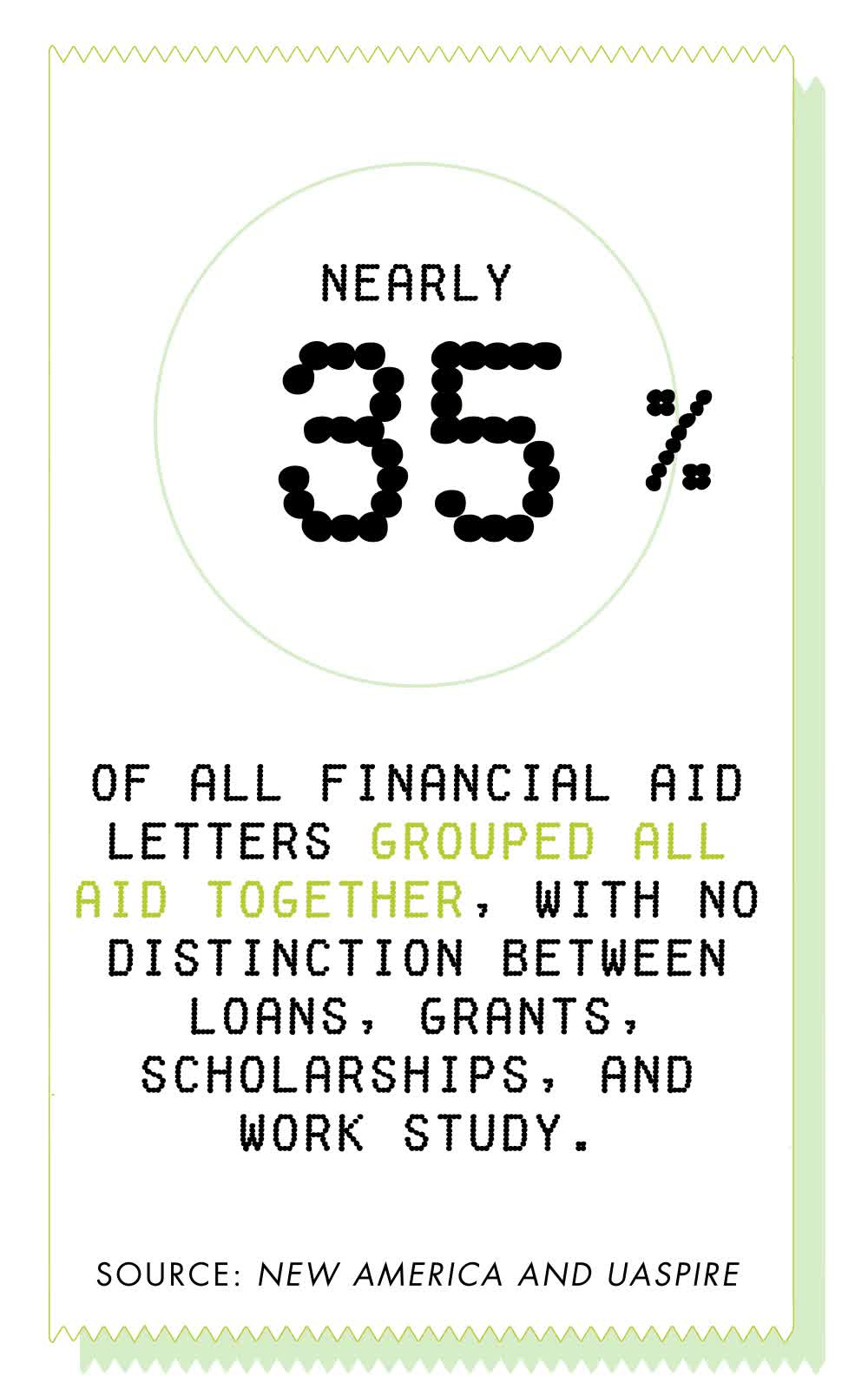

This finding comes from “Decoding the Cost of College: The Case for More Transparent Financial Aid Letters,” a research collaboration between UAspire and the New America Foundation published last year that reviewed 11,000 financial aid letters sent by some 5,000 colleges (both public and private) to the high school graduating class of 2016. The study found that one-third of letters failed to mention the overall cost of attendance, while 60 percent didn’t spell out students’ out-of-pocket expenses. What’s more, nearly 70 percent grouped all aid together, with no distinction made between grants, scholarships, work-study, and loans that a student would have to pay back, with interest.

An exclusive Cosmopolitan/Survey Monkey study echoed these findings: Only slightly more than half of women aged 18 to 34 who received financial aid letters said they felt informed about what they’d owe post-graduation. Meanwhile, just 41 percent of women said their college or university tried to help them understand their aid. These numbers contrasted starkly with the numbers for men, two-thirds of whom said they felt informed about their loans and 55 percent of whom said their college had made an attempt to help them.

(Perhaps it’s no wonder that 39 percent of men surveyed said they’d paid off their student loans, while just 28 percent of women said the same. Or that women currently hold two-thirds of the nation’s $1.5 trillion in student debt.)

Indeed, the student loan crisis adversely affects women—and it starts with the letter. Congratulatory letters that dangle big bucks without clearly stating what a student will have to pay herself, or pay back in loans, are tantamount to colleges “obfuscating their costs in ways that prevent good financial decision making,” says Rachel Fishman, deputy director for research with the Education Policy program at New America and coauthor of “Decoding the Cost of College.”

“To say, ‘Congratulations! You’ve been admitted and we’ve packaged you $30,000!’ but not also say, ‘You have to figure out the other $20,000 on your own’ is irresponsible,” adds Faith Sandler, the executive director of the Scholarship Foundation of St. Louis.

As a result, many freshmen enter college unaware that in order to graduate, they’ll have to take out loans that could equal or even outweigh the amount of free money being offered to them. Even after financial aid, students still owe an average of one-third of the cost of college, or $12,000 per year, according to the “Decoding” study—an amount that is way beyond the budget of most low-income families and middle-income families with other children in college or other high expenses, like medical bills.

In the weeks after receiving her $7,900 bill, Isabelle reached out repeatedly to SHU to ask for more money. She managed to eke out around $2,000 more, she says, from the financial aid office. She figured her mom could chip in a little. And because her mom, who was at the time (though is no longer) undocumented, couldn’t qualify for a high-interest Parent PLUS loan—a federal loan that parents can take out to help their kids pay for college—Isabelle managed to get another federal loan of her own. Still, getting a four-year degree from SHU now seemed highly unlikely.

Not wanting to lose her deposit, she showed up for her freshman year hoping for the best. But it soon became clear she wouldn’t be able to afford a second semester. That’s when she stopped going to Biochemistry Club. “It was pointless,” she says.

After finals, Isabelle transferred to UMass-Amherst, where tuition and fees are less than one-third the price of Sacred Heart. “I remember looking out the back window of my mom’s car, tearing up as we drove away, watching all my friends cry,” Isabelle says now. “Had SHU been more clear about the costs, I never would have gone there.”

(Savino, the SHU official who signed Isabelle’s letters, told Cosmo in an email that Isabelle’s first two letters were “merit-based aid letters” and not the actual “financial aid award letter” and therefore “[did] not necessitate a reiteration of cost of attendance as applicants have been provided estimated costs throughout the process via several different communications.”)

Ashley Pollack, now 26, also felt misled by her financial aid offer. She says she was offered half the cost of her first year at Central Michigan University (CMU) in Mount Pleasant, Michigan, in scholarships and the other half in subsidized and unsubsidized federal loans. “My original letter made it seem like I pretty much had a full ride,” she says.

But wait. A “full ride” covers everything: tuition, housing, meal plans, university fees. It does not include interest-bearing loans. “My high school counselor told me and my parents, ‘This is a great opportunity, you should take it,’” recalls Ashley. “I’m a first-generation college student and my parents didn’t understand the letter either, so for me it was just like, Okay, everyone else is going to college, I have to take this opportunity. I’m thinking, I’m not an athlete, I’m not super smart. This is my best option.”

Financial aid letters that fail to clearly distinguish between free money and loans, or bucket loans as “aid,” are “practically fraud,” says Kelly Peeler, CEO of Money-Mentor.com, a free text-message service that helps students navigate the financial aid process. “Yes, federal loans have lower interest rates than private bank loans, but you still owe money. Instead of saying, ‘Here is your financial aid award package,’ colleges should just say, ‘Here is your bill.’”

Confusion about what they’re taking on in loans “impacts the majority of students applying for aid,” says Colleen Campbell, director of post-secondary education at The Center for American Progress, a progressive think tank, adding that a student’s personal debt crisis “can definitely begin with the letter.”

Ashley’s letter did state the total cost of her tuition. But it didn’t account for the lab fees she’d face as an engineering student. And sophomore year, she still faced another rude awakening: Like so many students who assume certain scholarships will be renewed annually (because no one tells them otherwise), Ashley says she learned that two of the merit awards she had received—totaling about $3,000—were good for freshman year only. (A spokesperson for CMU said the university’s financial aid letters “include both a list of scholarships, grants, and awards [students] have received and an estimated cost of attendance....Students are also provided links to the Cost of Attendance Calculator and the Net Price Calculator, which they can use to determine their total Cost of Attendance based on their choices of meal plans and residence halls.”)

“My financial aid letter made things look very hopeful,” says Ashley now. “But I was very ignorant.” She ended up transferring after her sophomore year for personal reasons and graduated with $58,000 in debt. She is now working as a construction project manager. “I would have taken a different route if I had better understood the details of that first financial aid letter,” she says.

The National Association of Student Financial Aid Administrators (NASFAA), whose members serve 9 out of every 10 college undergrads, has an official Code of Conduct that says all financial aid letters must be clear and transparent. This means they must break down individual components of a student’s package, including whether everything is a gift or loan (and whether it can be renewed), plus state all charges billable to the student. The Code also calls for using standard terms and definitions found in a NASFAA glossary.

But a majority of aid letters don’t follow these guidelines. “There’s a lot of confusing jargon and terminology used in these offers,” Fishman says. “More often than not, students have to ask, ‘What exactly do I owe?’”

“Colleges make things tricky with their wording on purpose,” adds Dana Marvin, a college affordability counselor at Common Bond, a company that consolidates and refinances student loan debt. “They know that kids don’t understand anything about loans.”

Fishman says the entire concept of “merit aid” is a sham, a term slapped onto grants on the back end to make a financial aid offer look more attractive, regardless of whether you can actually afford it. “I hate to break it to students and families, but if you get a scholarship and it’s ‘merit’ from the institution…it’s really just a tactic to get you to enroll,” says Fishman.

Most every financial aid package offers unsubsidized federal loans–which are low interest but immediately start accruing interest (while subsidized loans don’t until after graduation). But according to the “Decoding” study, 400 colleges that offered this loan had 136 different names for it, making it impossible to compare offers. And 23 colleges didn’t even call them loans, instead truncating or abbreviating them as “ln” or “loa” or even more confusing, “direct unsub” or simply “unsubsidized.” Says Fishman, “Instead of elevating this most important part of financial aid, the loan, they are truncating it. Students have a right to know what they are about to borrow.”

Then there are the added costs and fees that some students face. Many schools don’t set their tuition until summer, making the financial aid award letter more of a guesstimate. Also, every school seems to calculate cost of attendance differently. COA, as it’s known, is what a school costs including and on top of tuition, encompassing books, university fees, lab fees, housing, and so on. Another huge cost that’s rarely factored in: health insurance, particularly when a student like Isabelle leaves her home state for college. There are also costs no financial aid letter will mention, such as origination fees, the service fees taken out of student loans to pay the government but still accrue interest and need to be paid back. Known as the “hidden student loan tax,” an origination fee is 1.06 percent for undergraduate students and 4.2 percent for grad students, adding $235 and $1,145 respectively—a cost that NASFAA president and CEO Justin Draeger once called “unconscionable.” In 2016, the federal government made $1.6 billion off origination fees.

“Most award letters don’t have anything related to the actual cost that the student will be billed for college the next year,” says Campbell. “Students might have an estimated cost and estimated aid, but when the rubber hits the road and it’s time to pay, those amounts are different. It could be that tuition actually increased from the previous year. It could be that there are additional fees that were not incorporated into the award. All kinds of things can be tacked onto the bill.”

“It’s really hard for students to figure out what their actual bill is going to be until they see it in front of them in the summer,” agrees Jennifer Smith, the former counselor at uAspire who worked with Isabelle.

What is certain, says neuroscientist Frances E. Jensen, MD, author of The Teenage Brain, is that teenaged students “should not be making these huge financial decisions alone.” Jensen’s perspective on financial aid letters is informed by her research on how teens make choices in situations where temptation can outshine stark reality. “This group is significantly more impressionable compared to full-fledged adults,” she says, noting that the frontal lobe—where decision making, judgment, and impulse control develop—needs several more years to fully mature. Incoming college students are more vulnerable, she says, to big money offers, even if tempered by the actual cost. “In the heat of the moment, the emotional charge of immediate gratification overrides any kind of due diligence,” she says.

What these students really need, she says, “is to be shown that if you borrow this much money now and compound it with interest, here are the monthly payments you will be making until you are 53.”

Fortunately, politicians agree that financial aid letters are a problem, and they are actually making moves to do something about it. In March of this year, senators Charles Grassley and Joni Ernst, both Iowa Republicans, along with Senator Tina Smith, a Minnesota Democrat, introduced three bills attempting to provide students with more accurate information about the cost of college before they sign on to attend. One of them, the Understanding the True Cost of College Act, focuses exclusively on award letters and would require schools to use the same standardized financial aid offer form—with uniform terminology—and clearly list information like cost of attendance and the amount the student is responsible for paying.

This form would make it easy for students to compare aid letters and see exactly what they’re taking out in loans, getting free in grants, and on the hook for themselves. A standard federal financial aid form already exists, but schools aren’t required to use it, so more than half don’t. “Students are flying blind when it comes to making one of the most important decisions of their lives,” said Senator Grassley in a statement.

Financial aid officers are not totally on board with this plan. “We do not want to see a fully standardized award letter where every single school’s award letter has to look exactly the same from the first line to the last line,” says Megan Coval, NASFAA’s vice president of policy and federal relations. She added that the group supports some standardized terms and a list of elements that every award letter has to include. But standardizing the whole award letter “does not allow for the flexibility that institutions need to best serve their students.”

And yet, what’s good for colleges—whose priority is competing to fill their seats—is not always what’s good for students, says a spokesperson for Senator Smith’s office. Meaning, requiring colleges to standardize their letters is the only way to fully crack down on confusing practices. In September, Senator Lamar Alexander, a Tennessee Republican and the chairman of the Senate Health, Education, Labor, and Pensions Committee, proposed to include the Understanding the True Cost of College bill in a larger higher education bill—meaning it’s gaining momentum.

One thing’s for sure, says National Association for College Admission Counseling president David Hawkins: The government has to do something. “I think we are headed toward more federal scrutiny,” he says.

Isabelle, meanwhile, has settled in at UMass, where she says she currently has all A’s in her classes and plans to double-major in biochemistry and neuroscience with a minor in Spanish. Her first semester at her new school was “rocky,” she said, since she’d grown accustomed to smaller class sizes at SHU. But she now has a work-study in a lab and is thinking of joining the orchestra. She still wants to be a doctor.

And yet, her financial woes persist. She’s already racked up roughly $10,000 in debt, including $5,000 she brought with her from Sacred Heart. And because some of her scholarships won’t renew next year, she’ll have to scramble to replace them. Also, UMass raised its tuition.

She expects she’ll feel a certain precariousness until she graduates—of not knowing, semester to semester, if she’ll actually be able to afford school, of numbers that shift constantly beneath her feet. “Worst comes to worst, I just don’t go to school for a semester and I work. I almost did that this semester,” she says.

“People like me, you never really know.”

Jennifer Wolff is an award-winning NYC-based journalist who focuses on both women's and men's health, financial well-being and travel.